Finance Analyst: The Mind Behind the Numbers

Finance Analyst In today’s fast-paced world of business and investments, where numbers hold the power to make or break empires, the role of a finance analyst is more crucial than ever. They are the interpreters of data, the storytellers of spreadsheets, and the decision-makers’ most trusted allies. But what does it really mean to be a finance analyst? Let’s dive into the fascinating world of this profession and understand the work they do, the skills they need, and why they matter more than ever in the global economy.

1. Who is a Finance Analyst?

A finance analyst is a professional who collects, monitors, and analyzes financial data to help businesses make informed decisions. These decisions might involve investment strategies, budgeting, forecasting, cost control, or overall financial planning. In simple terms, they translate complex numbers into clear insights and suggestions.

There are different types of finance analysts, such as:

- Investment Analysts: Focus on analyzing stocks, bonds, and other securities.

- Corporate Financial Analysts: Help companies with budgeting, forecasting, and financial strategy.

- Risk Analysts: Evaluate financial risks and suggest measures to mitigate them.

- Credit Analysts: Assess the creditworthiness of businesses or individuals.

Regardless of their specialization, all finance analysts have one key goal: turning data into actionable insights.

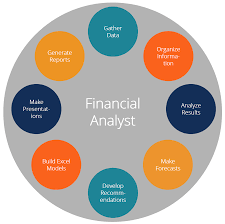

2. A Day in the Life of a Finance Analyst

A typical day for a finance analyst involves juggling numbers, reports, and meetings. Here’s a breakdown of their usual activities:

- Data Gathering: They start by collecting data from various sources – financial statements, market trends, economic indicators, and internal records.

- Data Analysis: Next, they analyze this data using tools like Excel, SQL, or financial software like SAP, Oracle, or Tableau. They identify trends, patterns, and anomalies.

- Financial Modeling: They create models that simulate financial scenarios. For instance, what happens to a company’s profits if raw material costs go up by 15%?

- Reporting: Analysts prepare detailed reports and presentations for management, highlighting key findings and recommendations.

- Meetings and Collaboration: They work closely with other departments such as accounting, marketing, and strategy teams to align financial plans with business goals.

Being a finance analyst is not just about number crunching; it’s about storytelling — using data to tell a story that drives smart decision-making.

3. Skills Every Finance Analyst Needs

Success as a finance analyst requires a blend of technical and soft skills. Here are the essentials:

a. Analytical Thinking

A finance analyst must think critically and dissect data to find hidden patterns and insights.

b. Excel Mastery

Excel is a finance analyst’s best friend. From VLOOKUP to pivot tables, mastering Excel is essential.

c. Communication Skills

An analyst needs to explain complex ideas simply and effectively — whether through written reports or verbal presentations.

d. Financial Knowledge

Understanding accounting principles, financial statements, and investment basics is foundational.

e. Software Proficiency

Familiarity with platforms like QuickBooks, SAP, Bloomberg Terminal, or Power BI can be a big plus.

f. Attention to Detail

In finance, a small error can lead to big consequences. Precision is a must.

g. Problem-Solving

Finance analysts are constantly solving problems — whether it’s finding ways to cut costs or improving revenue strategies.

4. Education and Career Path

Most finance analysts start with a bachelor’s degree in finance, economics, accounting, or business administration. Some go further to earn professional certifications like:

- CFA (Chartered Financial Analyst)

- CPA (Certified Public Accountant)

- FRM (Financial Risk Manager)

Others pursue MBA degrees to expand their expertise and move into leadership roles.

After gaining some experience, analysts can move up to roles like:

- Senior Financial Analyst

- Finance Manager

- Director of Finance

- Chief Financial Officer (CFO)

Some may transition into investment banking, private equity, or venture capital, depending on their interests.

5. Industries That Hire Finance Analysts

Finance analysts are needed across virtually every sector. Here are a few examples:

- Banking and Financial Services: Traditional employers offering roles in investment analysis, risk management, and credit analysis.

- Corporate Sector: Large firms in tech, retail, energy, and manufacturing rely on analysts for strategic financial planning.

- Government and Public Sector: Analysts help manage budgets and evaluate public investments.

- Startups and Small Businesses: Lean companies hire analysts to ensure financial health and scalability.

- Consulting Firms: Analysts in consulting firms help clients improve their financial operations.

Whether in a Fortune 500 company or a rising tech startup, finance analysts are in demand everywhere.

6. Tools of the Trade

Modern finance analysts are equipped with a suite of tools. Here are some of the most common:

- Microsoft Excel: Still the gold standard for financial modeling.

- Power BI / Tableau: For data visualization and reporting.

- SAP / Oracle / NetSuite: For enterprise financial management.

- Bloomberg Terminal / Reuters Eikon: For market data and analysis.

- Python / R: Increasingly popular for data analysis and automation.

Learning to use these tools efficiently can set an analyst apart in a competitive job market.

7. Challenges Faced by Finance Analysts

Despite its appeal, the role of a finance analyst is not without challenges:

- Tight Deadlines: Monthly, quarterly, and yearly reports all come with hard deadlines.

- Data Overload: Analysts must sift through massive amounts of data to find what really matters.

- Complex Regulations: Keeping up with changing financial laws and compliance issues is essential.

- Pressure to be Accurate: Mistakes can be costly and lead to wrong decisions.

- Cross-Functional Pressure: Analysts often need to explain or justify their findings to non-finance professionals who may not understand the details.

Handling these challenges with grace is what separates good analysts from great ones.

8. Why Finance Analysts Matter

Finance analysts play a critical role in shaping the financial health of companies. Here’s why they matter:

- Informed Decision-Making: Their insights guide strategic decisions — from expansions to acquisitions.

- Risk Management: They help identify and mitigate financial risks before they become problems.

- Efficiency: Analysts spot areas where companies can save money or improve operations.

- Performance Tracking: They monitor KPIs and help businesses stay on track with their goals.

Without finance analysts, businesses would be flying blind.

9. The Future of Finance Analysts

Technology is reshaping the finance world, and analysts must adapt. Here’s what the future holds:

- Automation: Routine tasks like data entry and reporting are increasingly automated, freeing analysts for more strategic work.

- AI and Machine Learning: Analysts are using AI to forecast trends and detect anomalies.

- Remote Work: More finance teams are embracing hybrid or remote setups, especially post-pandemic.

- Environmental, Social, and Governance (ESG): Analysts now consider ESG factors in their assessments as investors look beyond profits.

- Data Science Integration: More analysts are learning coding and statistics to enhance their analysis capabilities.

The finance analyst of the future is not just a number cruncher — they are data-savvy, tech-forward, and strategically minded.

10. Final Thoughts

In a world that runs on numbers, the finance analyst is the quiet powerhouse behind every successful decision. They help companies navigate uncertainty, seize opportunities, and grow with confidence. Whether you’re a student aspiring to join this field or a professional looking to understand it better, remember this: the heart of finance beats in analysis.